What is Car Insurance?

Car insurance is an agreement you make with an insurance company in which you pay a fixed amount of money in return for insurance coverage if the car is involved in an accident, stolen, or damaged. This policy will include repair or replacement of the property, medical costs, and lawyers’ fees.

Factors to Consider When Choosing Car Insurance

Choosing the right car insurance policy involves considering these factors to ensure you have the coverage you need at a price you can afford:

Coverage Needs

The first thing one does is establish their level of coverage. They’d determine the value of your car, how much of a risk you are on the road, and factors that you can foresee. If you have a luxurious car or you are a resident in a risky neighborhood, you may need additional features, which will cost more.

Deductibles and Premiums

Consider what deductible you’ll choose and the amount of money you have to pay before the insurance policy kicks in. Every insurance policyholder will prefer having a higher deductible because your premium will be cheaper. However, you will be paying more out of your pocket should a claim arise. Pick a niche that you can afford and offer you enough risk.

Promotions and Other Infomercials

You should not forget to inquire about a discount or package. Most insurance carriers provide additional deductions for safe driving, successful passing of the defensive driving course, or including car insurance with other insurance policies, such as homeowner’s or renter’s insurance.

Check the discounts list, and you may be able to cut the cost if you combine your policies.

Understanding Different Types of Car Insurance

There are several car insurance categories, meaning that policy comes with different degrees of protection. Understanding these types can help you choose the policy that aligns with your requirements:

Comprehensive Car Insurance

The highest level of protection is provided by this type of insurance, and it includes payments for damages to your car caused by various reasons, including theft, vandalism, and natural disasters. To understand what is full comprehensive insurance, it’s essential to recognize how this coverage addresses a wide range of potential risks and ensures financial security.

Third-Party Fire and Theft Car Insurance

Fire and theft insurance policy still covers your car if it is seized by fire or in theft. But it doesn’t pay for harm to your automobile in a crash other than if it occurred when it was stolen or burned.

Third-Party Car Insurance

Third-party-only car insurance is the least comprehensive and is usually the cheapest of the lot. It is just for liability and thus only pays for the damages to other people’s cars or property in the accident caused by you, not for your own car or your own body.

The Claims Process: What to Do After an Accident

Knowing what to do after an accident is crucial to ensure your safety and facilitate a smooth claims process:

Safety First

The first thing is to take care of yourself and any other person involved in the accident. If you have to, you drive your car off the road and check on yourself and others to see if you’re OK for injuries. If anyone feels uncomfortable or needs a doctor, get an ambulance immediately.

Gather Information

If there are other drivers involved in the accident, ask them questions like their names, where they live, how to contact them, the license plate number of the car they were driving, and their insurance details. Take pictures of the scene, the cars involved, and the physical injuries indicated.

Report the Accident

Immediately after an accident, you should also notify your insurance company. They will help you start the claim process and offer important details concerning the next steps to be taken.

Follow Instructions

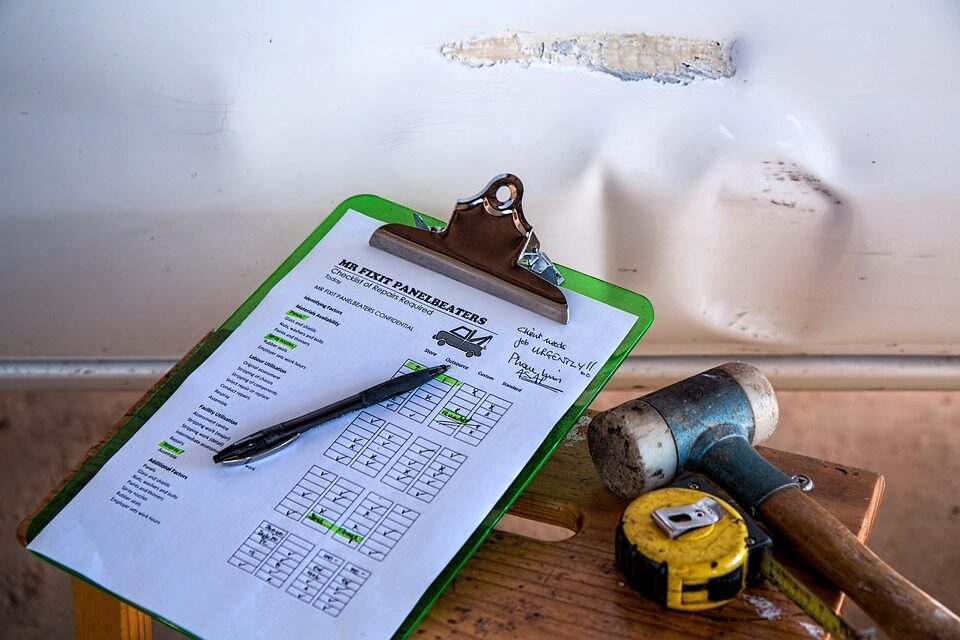

When you complete the initial assessment of your vehicle’s damage, follow your insurance provider’s instructions to upload or deliver any further documents they may seek. You may also be required to go to an assessment by a repairer.

Tips for Saving Money on Car Insurance

Car insurance can be a significant expense, but there are ways to save money without compromising on coverage:

Shop Around and Compare Quotes

Compare at least two insurance companies to arrive at an optimal solution. It is strongly advised not to grant yourself certain ties with your current carrier.

Keep looking around and see if you would agree with any other companies’ proposals regarding premiums, coverage, etc. Often, you may be shocked to discover that you can secure lower rates somewhere else.

Maintain a Good Driving Record

The record of your driving experience influences your car insurance costs to a large extent. If you have no past accidents, tickets, or violations, you can expect your insurer to give you lower rates. One would find that the insurance premium rate rises even for a single incidence of an accident or a traffic violation. Thus, drive defensively and do not get into an accident to have savings on your premium charges.

Increase Your Deductible

Your deductible is the amount that falls within your realm when it comes to paying for your medical expenditures; the rest is paid by your insurance company if you choose a high deductible then your premium payments will be lower. However, do not go for a high deductible if it will strain your pocket each time there is an accident.

Bundle Your Policies

Some insurers offer a discount if you have automobile insurance along with other policies, including home, life, or renters. This can save you plenty of money and make it easy for you to sort out your bills.

Conclusion

Car insurance is very important in society, especially for those who operate cars. It covers any mishap, theft, or destruction of your automobile. Therefore, realizing the various types of coverage, how to decide on a suitable policy, and steps to take to save money, the consumer is well placed to make proper decisions as to the extent of the coverage to take and at what cost. It is possible to drive a car more conveniently when one has made the right insurance policy that fulfills his/her requirements.